Finding the Right Angle – Multi Strategy Allocation Approach

The Multi–Strategy Fund finds unique opportunities through an agile yet focused approach.

The Multi-Strategy approach represents one of North Square’s core investment ideas – to provide active portfolios that are meaningful to diversification. The idea that active investors can add strategic value to investment portfolios in asset classes is guided by a focused, research-driven process.

As is often the case with market movements, certain asset classes may become distorted in the short-term while the long-term outlook remains unchanged. This is when a flexible, long-term portfolio allocation strategy can be driven by research expertise. An intuitive straight forward approach can navigate portfolio positioning through these market conditions.

Bringing together the best opportunities.

Investment Approach

By partnering with asset managers in niche areas, North Square aims to build a diversified lineup of investment strategies. The Multi-Strategy team combines these diversified investment strategies with internal research to arrive at a portfolio allocation that seeks to outperform the market over the long-term.

Within this backdrop, the portfolio team’s view of a specific asset class can be positive, negative, or neutral. Allocation weights tend to focus on areas where the team is more confident, carrying a higher weight in the portfolio. Likewise, when the team believes there is more uncertainty around a specific area, the weighting becomes neutral or underweight.

Research inputs

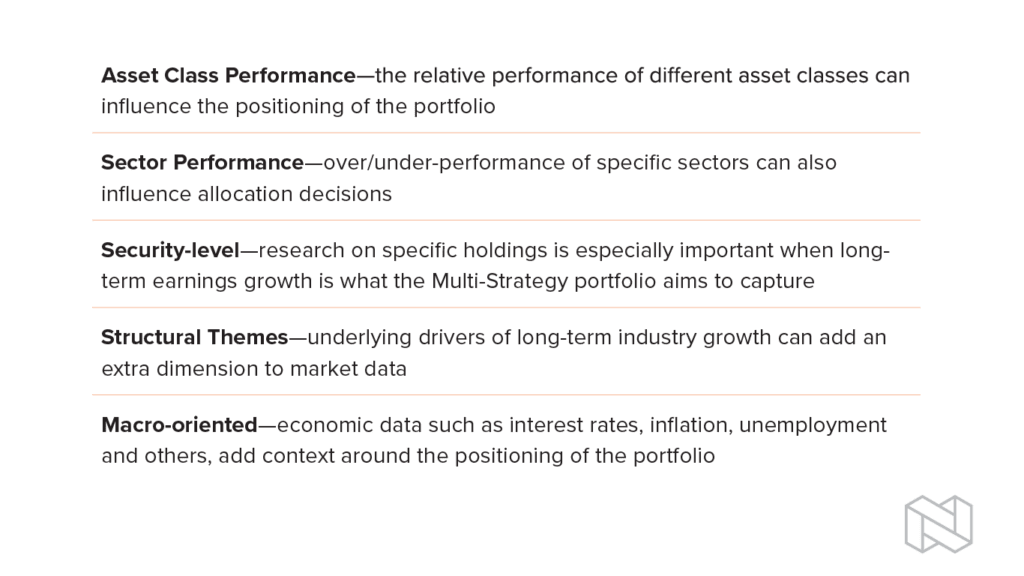

Overall, the Multi-Strategy team takes less of a view on where markets are going but looks for lasting themes that may enhance long-term return potential. By drawing on North Square’s affiliated asset management partners, this expertise complements the team’s own research. Analysis is driven by many factors – asset class performance, sector performance, security-level information, asset class structural themes, and macro-oriented data.

Agile within a methodical framework.

INVESTMENT PROCESS

As a starting point, the portfolio takes an equal-risk contribution approach. From there, research input and return expectations are combined to implement weighting tilts into the portfolio. The Multi-Strategy team uses an intuitive asset allocation approach within this defined, risk-controlled model.

Implied Market Returns + Investor Views = Expected Returns

The portfolio is highly flexible in its asset allocation, enabling portfolio managers to dynamically adjust positioning across equities, fixed income and cash to maintain a stable risk profile. This is based on insights driven by quantitative and fundamental analysis across asset classes.

The team also allocates tactically within asset classes; for example, between equity regions and sectors, and fixed income sub-sectors with the aim of adding strategic value over a full market cycle. They not only seek to enhance participation in rising markets, but also provide protection during volatile declining markets.

Steps

The strategy compares relative risk and return compared to the Russell 3000 Index. This index is also used to understand relative sector allocations (both overweight and underweight), returns over time and market volatility levels. When beneficial for additional exposure, the team will supplement the North Square suite of managers with external managers.

- Establish implied market returns across asset classes

- Formulate investor views of respective asset classes

- Determine expected returns given these investor views

- Find optimal asset allocation for best long-term risk and return

Equal-Risk Contribution:

Defined as a broad approach to risk-budgeting where portfolio holdings each contribute equally to overall portfolio risk. The Multi-Strategy Fund takes this approach as a theoretical starting point in order to seek diversification that is not dependent on any one asset class, or holding. The portfolio is then further weighted to reflect the portfolio team’s view of these holdings and asset classes.

Benefits

With a unique mix of research insight, and a keen eye on global opportunities, the Multi-Strategy Fund invests for the long-term. Given North Square’s unique partnership with leading asset management boutiques, the portfolio aims to reflect the best ideas for growth over time.

By targeting the risk profile of a balanced equity strategy, the Fund can seek exposure in diversified areas. This may mean different exposure overall to foreign and domestic equity, plus fixed income, all while balancing risk among investments the team finds most attractive.

Compared to a U.S. equity index like the Russell 3000 Index, foreign equity and fixed income can play a role in diversification and generating income when necessary. Being mindful of structural circumstances in foreign and fixed income markets, the strategy can offer more flexibility than an equity- or fixed income-only portfolio.

Important Risks: Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. Investments made in small capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund invests in foreign securities which involves certain risks such as currency volatility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. The Fund invests in ETFs (Exchange-Traded Funds) and is therefore subject to the same risks as the underlying securities in which the ETF invests as well as entails higher expenses than if invested into the underlying ETF directly. Fixed income securities are subject to credit risk, including the risk of nonpayment of principal or interest. The prices of fixed income securities respond to economic developments, particularly interest rate changes, as well as to changes in an issuer’s credit rating or market perceptions about the creditworthiness of an issuer.